Life insurance is more than just a financial product; it's a safety net that provides peace of mind for you and your loved ones. As life unfolds with unexpected twists and turns, having a solid life insurance policy ensures that your family remains financially secure even in your absence. Whether you're a young professional, a parent, or nearing retirement, understanding life insurance is crucial for long-term financial planning.

Many people underestimate the importance of life insurance, thinking it's only necessary for those with dependents. However, this financial tool offers far-reaching benefits, from covering funeral expenses to ensuring your beneficiaries receive financial support. In today's fast-paced world, where medical costs and living expenses continue to rise, life insurance serves as a critical component of personal finance.

This guide will delve into the intricacies of life insurance, covering everything from the basics to advanced strategies. We'll explore the types of policies available, factors to consider when purchasing coverage, and how to maximize the benefits of your policy. By the end of this article, you'll have a comprehensive understanding of how life insurance can safeguard your future and legacy.

Read also:Emily Compagno Workout Your Ultimate Guide To Fitness And Motivation

Table of Contents

- What is Life Insurance?

- Types of Life Insurance

- Importance of Life Insurance

- How Life Insurance Works

- Choosing the Right Policy

- Costs and Premiums

- Beneficiaries and Claims

- Tax Implications

- Common Mistakes to Avoid

- Future Trends in Life Insurance

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company, where the insurer agrees to pay a designated beneficiary a sum of money upon the policyholder's death. In exchange, the policyholder pays regular premiums to maintain the coverage. This financial arrangement provides a safety net for loved ones, ensuring they can meet financial obligations even after the policyholder's passing.

At its core, life insurance serves as a risk management tool, transferring the financial burden of unexpected events to the insurer. It offers peace of mind, knowing that your family will be taken care of, regardless of unforeseen circumstances. Whether you're securing your children's education, paying off debts, or ensuring a stable income for your spouse, life insurance plays a pivotal role in financial planning.

Key Features of Life Insurance

- Death benefit: The amount paid to beneficiaries upon the policyholder's death.

- Premiums: Regular payments made by the policyholder to keep the coverage active.

- Policy term: The duration for which the policy remains valid.

- Cash value (in some policies): An additional feature that allows policyholders to accumulate savings.

Types of Life Insurance

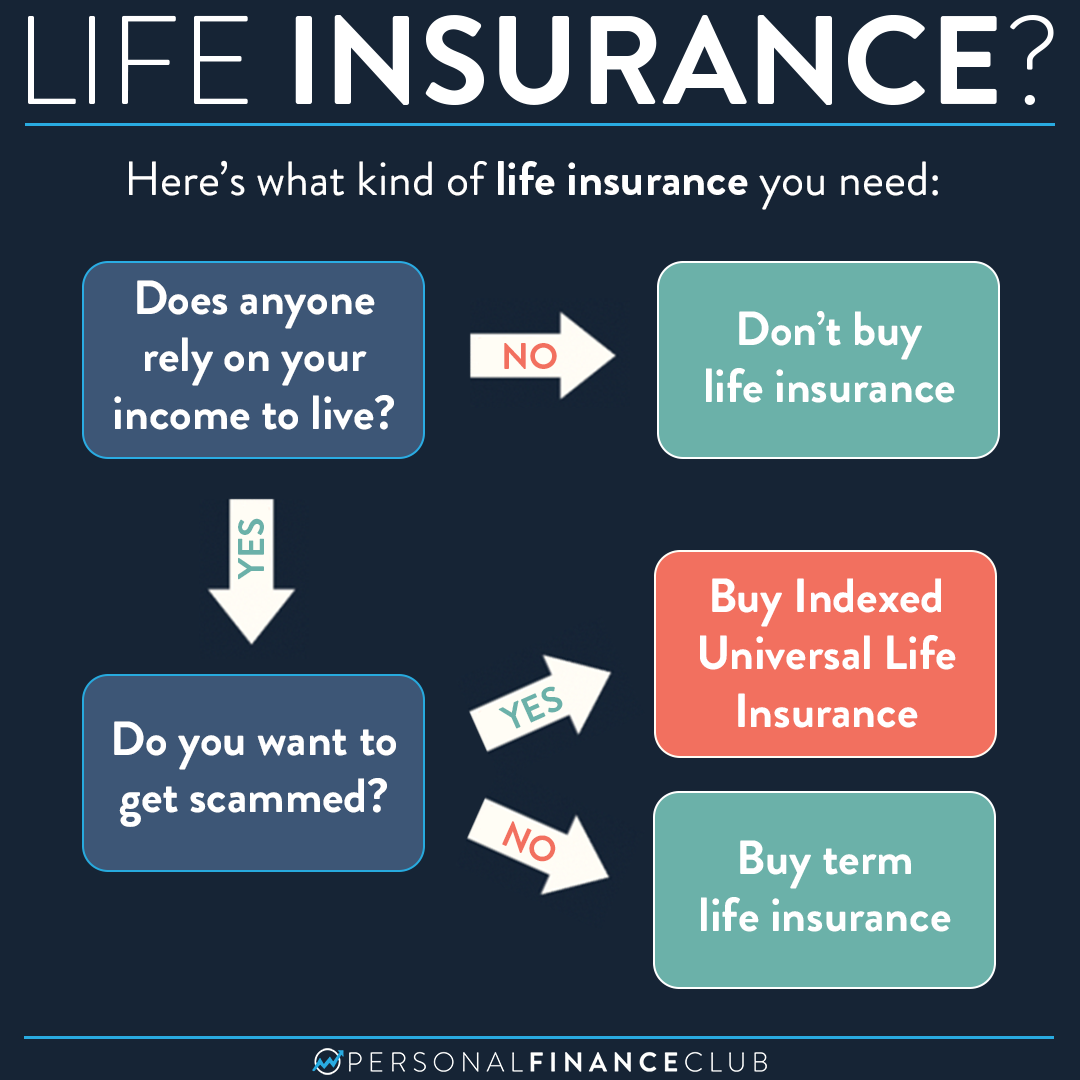

Not all life insurance policies are created equal. Understanding the different types of coverage is essential to choosing the right option for your needs. Below are the primary categories of life insurance:

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is generally more affordable than permanent policies and is ideal for individuals who need coverage for a defined timeframe, such as during their working years or while raising children.

Whole Life Insurance

Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. While premiums are higher than term policies, this type of insurance provides a guaranteed death benefit and can serve as an investment vehicle.

Universal Life Insurance

Universal life insurance combines the flexibility of term coverage with the cash value accumulation of whole life policies. Policyholders can adjust premiums and coverage amounts, making it a versatile option for those seeking customizable protection.

Read also:Denzel Washington Passed Away Debunking The Myth And Celebrating A Legendary Career

Importance of Life Insurance

Life insurance is not just a luxury; it's a necessity for anyone with financial responsibilities. Here are some key reasons why life insurance is vital:

Firstly, it provides financial security for dependents, ensuring they can maintain their standard of living. Secondly, it helps cover debts and expenses, such as mortgages, student loans, and medical bills. Lastly, life insurance can fund future goals, like education or retirement, for the policyholder's loved ones.

Statistical Evidence

According to the LIMRA, approximately 40% of U.S. households lack adequate life insurance coverage. This statistic underscores the critical need for individuals to evaluate their protection needs and secure the appropriate policy.

How Life Insurance Works

The mechanics of life insurance are relatively straightforward. When you purchase a policy, you agree to pay regular premiums in exchange for a guaranteed death benefit. The insurer evaluates your risk profile, considering factors like age, health, and lifestyle, to determine the premium amount.

Upon the policyholder's death, the designated beneficiaries file a claim with the insurance company. Once verified, the insurer disburses the death benefit, providing immediate financial relief to the grieving family. This process ensures a seamless transition, minimizing the financial strain during an emotional time.

Underwriting Process

- Medical examination: Assessing the policyholder's health status.

- Risk assessment: Evaluating factors like age, occupation, and hobbies.

- Premium calculation: Determining the cost of coverage based on risk factors.

Choosing the Right Policy

Selecting the appropriate life insurance policy requires careful consideration of several factors. Begin by evaluating your financial obligations and future needs. For instance, if you have young children, you may need a policy that covers their education expenses. Similarly, if you're nearing retirement, a policy with a cash value component might be more suitable.

Factors to Consider

- Amount of coverage: Determine how much financial protection your family requires.

- Policy duration: Decide whether term or permanent coverage aligns with your goals.

- Cost: Compare premiums and evaluate the long-term affordability of the policy.

- Reputation of the insurer: Choose a reputable company with a strong financial rating.

Costs and Premiums

The cost of life insurance varies based on several factors, including age, health, and coverage amount. Generally, younger individuals with no significant health issues pay lower premiums. Additionally, policies with shorter terms or fewer benefits tend to be more affordable.

It's essential to shop around and compare quotes from multiple insurers to find the best value. Many companies offer online tools to estimate premiums, making it easier to assess your options. Remember that while cost is a critical factor, it should not be the sole determinant in your decision-making process.

Ways to Save on Premiums

- Purchase coverage at a younger age.

- Maintain a healthy lifestyle to qualify for lower rates.

- Opt for group insurance through your employer.

- Bundle policies with the same insurer for discounts.

Beneficiaries and Claims

Designating beneficiaries is a crucial step in the life insurance process. Beneficiaries are the individuals or entities that receive the death benefit upon the policyholder's passing. It's important to update your beneficiary information regularly, especially after significant life events like marriage or the birth of a child.

When filing a claim, beneficiaries must provide the insurer with a certified copy of the death certificate and the policy document. The insurer will review the claim and disburse the funds according to the terms of the policy. While the process is generally straightforward, it's advisable to consult the insurer's guidelines to ensure a smooth experience.

Tips for Beneficiary Designation

- Choose primary and contingent beneficiaries.

- Specify percentages if multiple beneficiaries are involved.

- Avoid naming minors as direct beneficiaries.

- Review and update beneficiary information annually.

Tax Implications

Life insurance offers several tax advantages that make it an attractive financial tool. In most cases, the death benefit paid to beneficiaries is tax-free. Additionally, the cash value component of permanent policies grows tax-deferred, allowing policyholders to accumulate wealth without immediate tax liabilities.

However, certain scenarios may trigger taxable events. For example, if the policy is sold or transferred for valuable consideration, the gain may be subject to taxation. It's crucial to consult a tax professional or financial advisor to understand the specific implications of your policy.

Key Tax Benefits

- Tax-free death benefit for beneficiaries.

- Tax-deferred growth of cash value.

- Potential tax deductions for business-related policies.

Common Mistakes to Avoid

While life insurance is a valuable tool, many individuals make mistakes that can undermine its effectiveness. Below are some common pitfalls to avoid:

- Purchasing inadequate coverage: Underinsuring yourself can leave your loved ones financially vulnerable.

- Choosing the wrong policy type: Selecting a policy that doesn't align with your needs can result in wasted resources.

- Ignoring inflation: Failing to account for inflation when determining coverage amounts can diminish the policy's value over time.

- Not reviewing policies regularly: Life circumstances change, and your policy should evolve accordingly.

Future Trends in Life Insurance

The life insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. One significant trend is the increased use of digital tools for policy management and claims processing. Insurers are also leveraging data analytics and artificial intelligence to enhance underwriting accuracy and customer service.

Another emerging trend is the integration of wellness programs into life insurance policies. By encouraging policyholders to adopt healthy lifestyles, insurers aim to reduce risk and improve outcomes for both parties. As these trends continue to develop, consumers can expect more personalized and efficient insurance solutions.

Innovations in the Industry

- Mobile apps for policy management.

- Telemedicine integration for health assessments.

- Sustainability-focused policies supporting eco-friendly practices.

Conclusion

Life insurance is a cornerstone of financial planning, offering protection, peace of mind, and long-term security for you and your loved ones. By understanding the different types of policies, evaluating your needs, and selecting the right coverage, you can ensure that your family remains financially stable in your absence. Remember to review your policy regularly and consult professionals when necessary to maximize its benefits.

We encourage you to take action by evaluating your current coverage and exploring options that align with your financial goals. Share this article with friends and family to help them understand the importance of life insurance. For more insights on personal finance and insurance, explore our other resources and stay informed about the latest trends in the industry.