George Wallace's warning to Elon Musk over financial matters has sparked widespread attention and debate. The discussion revolves around the implications of Musk's financial decisions on broader economic stability. This article delves into the nuances of Wallace's concerns, exploring the potential impacts and offering insights into the financial landscape.

As one of the most influential figures in the modern business world, Elon Musk continues to make headlines with his bold financial strategies. However, George Wallace, a renowned economist and financial analyst, has recently voiced concerns about these decisions. His warnings highlight critical issues that could affect not only Musk's ventures but also the global financial ecosystem.

This article aims to provide a detailed examination of George Wallace's perspective, offering readers a comprehensive understanding of the financial implications at play. By exploring various aspects of the issue, we hope to shed light on the potential consequences and encourage informed discussions among stakeholders.

Read also:Carnie Wilson Family An Insight Into The Life Career And Legacy

Table of Contents

- Biography of George Wallace

- Financial Context and Background

- Elon Musk's Financial Decisions

- Wallace's Concerns Over Musk's Strategies

- Potential Economic Impact

- Global Perspective on Financial Stability

- Market Reactions to the Warning

- Historical Precedents and Lessons

- Proposed Solutions and Recommendations

- Conclusion and Call to Action

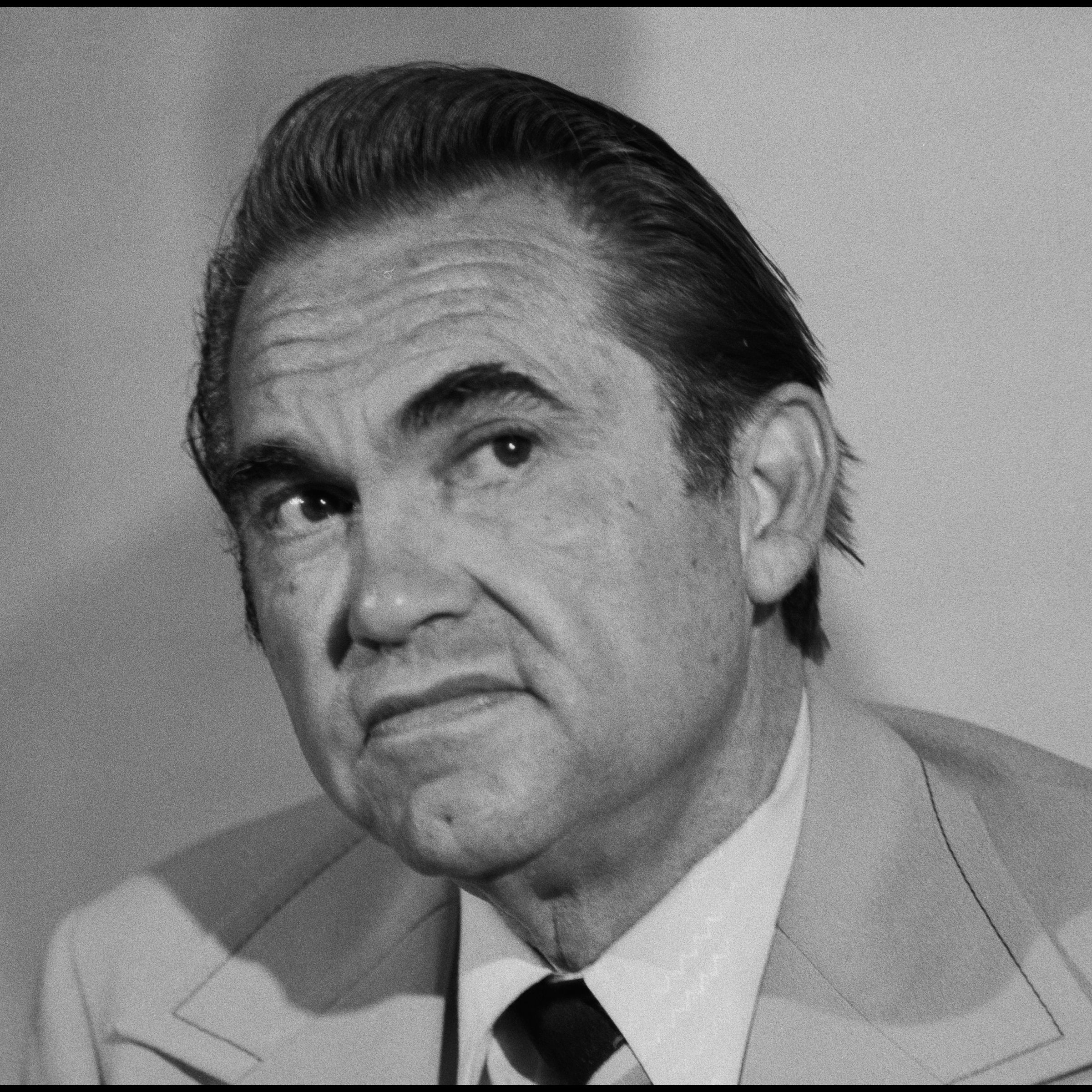

Biography of George Wallace

George Wallace is a distinguished economist known for his insightful analyses of global financial systems. With decades of experience in academia and the financial sector, he has earned a reputation for his expertise in economic policy and market dynamics.

Personal Data and Biodata

| Full Name | George Wallace |

|---|---|

| Occupation | Economist, Financial Analyst |

| Field of Expertise | Global Economics, Financial Stability |

| Education | Ph.D. in Economics, Harvard University |

| Notable Works | "The Future of Financial Markets," "Economic Stability in the Digital Age" |

Wallace's work has been widely recognized in academic circles and the financial industry, making him a trusted voice in discussions about economic policy and financial decision-making.

Financial Context and Background

To fully understand George Wallace's warnings, it is essential to examine the broader financial context. The global economy is currently navigating unprecedented challenges, including inflation, geopolitical tensions, and technological disruptions.

Key Financial Trends

- Inflation rates have surged across major economies, raising concerns about purchasing power.

- Central banks are recalibrating monetary policies to address these challenges.

- Technological advancements, particularly in cryptocurrencies, are reshaping traditional financial systems.

These trends set the stage for Wallace's critique of Musk's financial decisions, highlighting the complexities involved in modern economic management.

Elon Musk's Financial Decisions

Elon Musk, the CEO of Tesla and SpaceX, has consistently pushed the boundaries of innovation and finance. His ventures have not only revolutionized industries but also introduced new financial paradigms.

Notable Financial Moves

- Investment in cryptocurrencies, particularly Bitcoin, positioning Tesla as a leader in digital asset adoption.

- Expansion into space exploration, requiring significant capital investment and financial innovation.

- Acquisition of Twitter, raising questions about the financial sustainability of the deal.

Musk's bold financial strategies have garnered both praise and criticism, with experts like George Wallace offering differing perspectives on their implications.

Read also:Pixie Haircut On Square Face The Ultimate Guide To Flattering Styles

Wallace's Concerns Over Musk's Strategies

George Wallace has expressed several concerns regarding Musk's financial decisions. His warnings focus on the potential risks these strategies pose to broader economic stability.

Risk Factors

- Over-reliance on volatile digital assets could destabilize corporate finances.

- Aggressive expansion into high-risk ventures may strain financial resources.

- Lack of transparency in financial dealings could erode investor confidence.

Wallace argues that while Musk's ventures are innovative, they require careful financial management to ensure long-term sustainability.

Potential Economic Impact

The implications of Musk's financial decisions extend beyond individual companies, affecting the broader economic landscape. Wallace's warnings highlight several potential impacts.

Areas of Concern

- Market volatility could increase due to Musk's high-profile financial moves.

- Investor sentiment may shift, influencing capital flows and market dynamics.

- Regulatory scrutiny could intensify, leading to stricter oversight of corporate finances.

Understanding these potential impacts is crucial for stakeholders seeking to navigate the complexities of modern finance.

Global Perspective on Financial Stability

From a global perspective, Wallace's warnings resonate with broader discussions about financial stability. The interconnectedness of modern economies means that decisions made by influential figures like Musk can have far-reaching consequences.

Global Financial Trends

- Emerging markets are increasingly influenced by the financial strategies of major corporations.

- Regulatory frameworks are evolving to address new financial challenges.

- Collaboration among global financial institutions is essential for maintaining stability.

Wallace's analysis underscores the importance of responsible financial stewardship in an interconnected world.

Market Reactions to the Warning

Wallace's warnings have prompted varied reactions in financial markets. Investors and analysts are closely monitoring the situation, assessing the potential implications for their portfolios.

Market Dynamics

- Stock prices of Musk's companies have shown volatility following Wallace's comments.

- Analysts are revisiting their projections, incorporating Wallace's concerns into their models.

- Investor sentiment remains mixed, with some viewing the warnings as a call for caution and others dismissing them as overly pessimistic.

These reactions highlight the ongoing debate about the role of influential figures in shaping financial markets.

Historical Precedents and Lessons

History offers valuable lessons about the impact of financial decisions on economic stability. Wallace's warnings draw parallels to past events, emphasizing the importance of learning from experience.

Key Historical Examples

- The dot-com bubble of the late 1990s highlighted the risks of speculative investments.

- The 2008 financial crisis demonstrated the dangers of excessive risk-taking in financial markets.

- Regulatory reforms following these events underscored the need for prudent financial management.

By examining these precedents, stakeholders can better appreciate the significance of Wallace's warnings and the importance of responsible financial practices.

Proposed Solutions and Recommendations

To address the concerns raised by George Wallace, several solutions and recommendations have been proposed. These aim to ensure the long-term sustainability of Musk's ventures while promoting broader economic stability.

Strategic Recommendations

- Enhance transparency in financial dealings to build investor confidence.

- Diversify investment portfolios to mitigate risks associated with volatile assets.

- Engage in constructive dialogue with regulators to align corporate strategies with broader economic goals.

Implementing these recommendations could help mitigate the risks associated with Musk's financial decisions, fostering a more stable financial environment.

Conclusion and Call to Action

In conclusion, George Wallace's warnings about Elon Musk's financial decisions highlight critical issues that warrant careful consideration. By examining the broader financial context, understanding the implications of Musk's strategies, and learning from historical precedents, stakeholders can make informed decisions to promote economic stability.

We invite readers to engage in this discussion by sharing their thoughts and insights. Your input is valuable in shaping the discourse around financial decision-making and its impact on the global economy. Additionally, explore other articles on our site to deepen your understanding of these complex issues.